Publicité

Abrogation du traité de non-double imposition entre Maurice et la Zambie

Par

Partager cet article

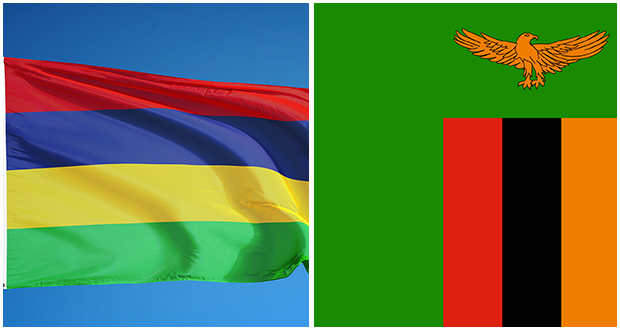

Abrogation du traité de non-double imposition entre Maurice et la Zambie

La Zambie ne veut plus d'un accord de non-double imposition aux termes duquel la plupart des bénéfices fiscaux revient à Maurice. Sur les instructions du président zambien, le conseil des ministres a recommandé l'abrogation de l'actuel accord pour le remplacer par un nouveau, où le principe de l'équité par rapport aux bénéfices qu'engendre un tel traité est respecté. Ci-dessous la décision du conseil des ministres de la Zambie:

«Agreement between the Government of the Republic of Zambia and the Government of the Republic of Mauritius for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with Respect to Taxes on Income.

Cabinet also approved the termination of the Avoidance of Double Taxation Agreement between the Government of the Republic of Zambia and the Government of the Republic of Mauritius and initiate negotiations of a new Agreement which will introduce shared taxing rights and anti-abuse clauses. Cabinet resolved to terminate the Agreement which came into force on 15th June, 2012 as the Agreement deals with income from a number of specific sources, such as business income, dividends, interest and royalties. It gives exclusive taxation in the country of residence of the receipt of the income. As such, Zambia does not retain taxing rights to tax dividends, interest and royalties arising in Zambia and payable to residents of Mauritius.»

Publicité

Les plus récents